- August 25, 2023

- Dennis Frank

- 0

Table of Contents

FedNow: Understanding the Benefits and Misconceptions Behind the New Payment System

In recent months, the term “FedNow” has beenbuzzing around in the world of payments and finance. The Federal Reserve has announced the upcoming launch of this new payment system, which promises to offer instant and 24/7 payments for individuals and businesses alike. However, amidst all the hype surrounding FedNow, there has also been a fair share of misconceptions and uncertainties. In this article, we will take a closer look at FedNow, separating fact from fiction, and exploring the benefits, limitations, and potential impact of this new service.

FedNow: Separating Fact from Fiction

Understanding the FedNow Service and Its Purpose

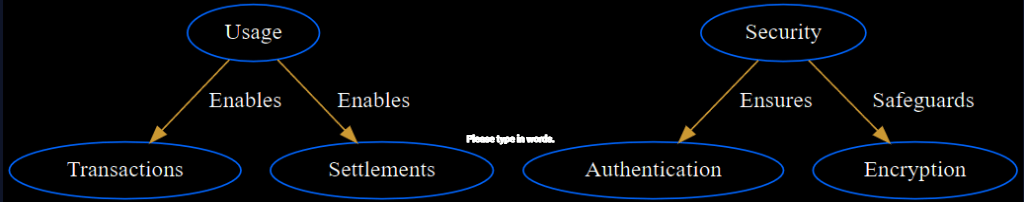

FedNow is a new payment system that has been designed by the Federal Reserve to facilitate instant and safe payments within the United States. The service is scheduled to launch in 2023 and will allow individuals and businesses to make and receive payments in real-time, 24 hours a day, 7 days a week. This means that you will be able to send and receive money instantly, regardless of the time of day or day of the week.

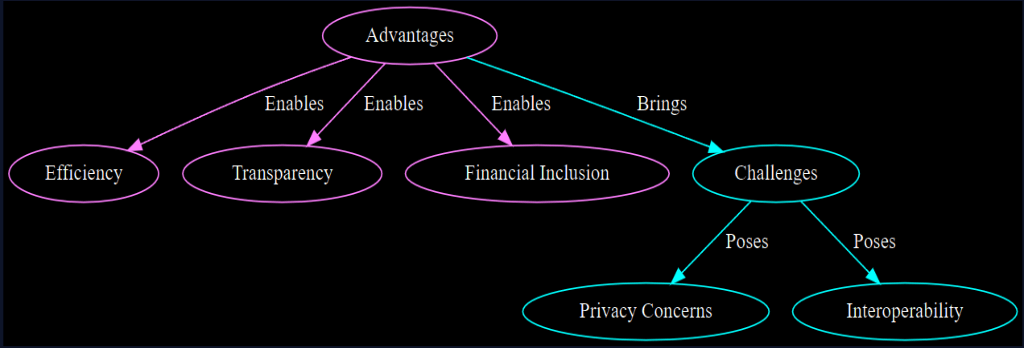

One of the key benefits of FedNow is that it will provide a more efficient, cost-effective, and secure payment infrastructure for all participants in the payment system. This includes individuals, small businesses, and large corporations. Currently, many payment transactions can take several days to clear, which can be frustrating for businesses that need to manage their cash flow. With FedNow, payments will be settled instantly, which will help businesses to better manage their finances and reduce the risk of fraud.

Another important benefit of FedNow is that it will provide greater access to real-time payments for all participants in the payment system. Currently, many individuals and businesses do not have access to real-time payments, which can limit their ability to participate in the economy. With FedNow, anyone with a bank account will be able to send and receive payments instantly, which will help to promote financial inclusion and reduce the reliance on cash.

Debunking the Myth of FedNow as a Digital Currency

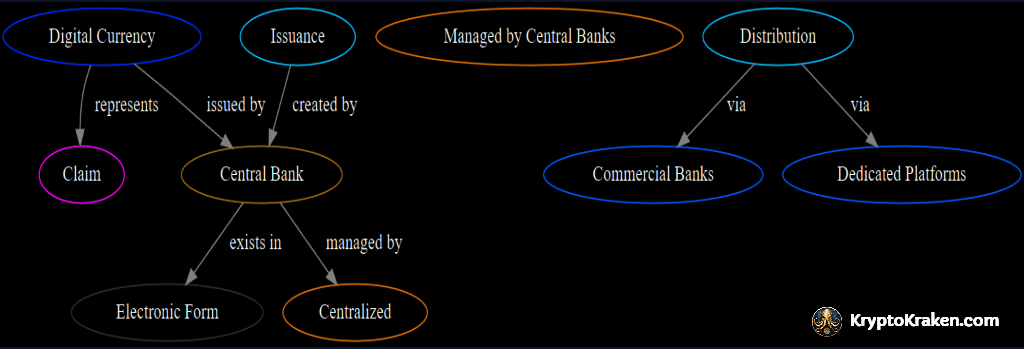

One of the biggest misconceptions about FedNow is that it is a new digital currency. In reality, FedNow is a payment system, not a currency. It is not intended to replace existing payment methods, such as cash or credit cards, but rather to provide a faster and more reliable way to settle payments between banks. FedNow will work within the existing framework of the U.S. payment system and will be accessible through participating banks and credit unions.

It is important to note that FedNow is not a cryptocurrency, nor is it based on blockchain technology. Rather, it is a centralized payment system that will be managed by the Federal Reserve. This means that it will be subject to the same regulations and oversight as other payment systems in the United States.

Overall, FedNow represents an exciting development in the U.S. payment system. By providing instant and safe payments, FedNow will help to promote financial inclusion, reduce the reliance on cash, and improve the efficiency of the payment system for all participants. While there are still some misconceptions about the service, it is clear that FedNow will be an important tool for businesses and individuals alike in the coming years.

The Benefits and Limitations of FedNow

How FedNow Aims to Improve the Payment System

FedNow is expected to provide significant benefits to individuals and businesses alike. One of the main advantages of FedNow is that it will enable instant payments, which will eliminate the need for delayed settlement times and reduce the risk of fraud and errors in payment processing. Moreover, FedNow will offer a more cost-effective way to settle payments, as it will eliminate the need for intermediaries and third-party payment processors. Additionally, FedNow will expand access to real-time payments, enabling a wider range of businesses to accept instant payments.

The Potential Impact of FedNow on Businesses and Consumers

FedNow has the potential to transform the payment landscape in the United States, particularly for small businesses and consumers. By enabling instant payments, FedNow will provide immediate access to funds, which will make it easier for businesses to manage cash flow and payments. Moreover, FedNow will enable businesses to offer faster and more reliable payment options to their customers, thereby improving the overall customer experience. For consumers, FedNow will provide a more convenient way to make payments, with no more waiting times for funds to clear.

Exploring the Future of Digital Currency in the US

An Overview of the Current State of Digital Currency in the US

While FedNow is not a digital currency, it is worth exploring the potential role of digital currency in the U.S. payment system. Digital currencies, such as Bitcoin and Ethereum, have gained popularity in recent years, with some advocates calling for them to become the new global currency. However, digital currencies are still not widely accepted for payment transactions, and their value can be volatile, which limits their use as a reliable payment method. Additionally, there is a lack of regulation in the digital currency market, which poses risks to investors and consumers alike.

The Pros and Cons of a Digital Currency for the US Economy

There are several potential benefits and drawbacks to the adoption of a digital currency in the United States. On the one hand, a digital currency could provide a more secure and efficient way to make payments, with no need for intermediaries or third-party processors. Additionally, a digital currency could provide greater financial inclusion, particularly for those who are currently unbanked or underbanked. On the other hand, a digital currency could potentially undermine the stability of the U.S. dollar and the existing monetary system, and could pose regulatory challenges in terms of taxation and money laundering.

Fact-Checking the Claims About FedNow

Examining the Evidence Behind the Claims About FedNow

As with any new technology, there have been plenty of claims made about the potential impact and benefits of FedNow. It is important to examine these claims closely and evaluate the evidence behind them. For example, some have claimed that FedNow will provide a boost to small businesses and reduce the cost of payment processing. These claims are based on the assumption that FedNow will be a more cost-effective and efficient way to settle payments, but this remains to be seen until the service is actually launched.

Identifying Misinformation About FedNow and Digital Currency

Unfortunately, there is also plenty of misinformation and misunderstanding surrounding both FedNow and digital currency. One common misconception is that FedNow will replace the existing payment system or compete with existing payment methods, which is not the case. Another misconception is that digital currency is inherently secure and anonymous, when in reality, it can be subject to security breaches and fraud. It is important to separate fact from fiction when it comes to FedNow and digital currency, and to evaluate these new developments based on their potential benefits and drawbacks.

Conclusion

Overall, FedNow represents an exciting new development in the U.S. payment system, with the potential to provide significant benefits to individuals and businesses alike. While there are still some uncertainties and misconceptions surrounding FedNow and digital currency, it is important to evaluate these developments based on their potential impact and benefits. Ultimately, FedNow offers the promise of a faster, more reliable, and more accessible way to settle payments in the United States, which could help to boost economic growth and improve the lives of millions of Americans.

⭐⭐⭐ Enjoy learning through video? See the entire video collection at KryptoKraken Videos